Cryptocurrency, a term that has become increasingly prevalent in our digital age, represents a revolutionary form of currency that operates independently of traditional banking systems. As technology continues to advance, understanding what cryptocurrency is and how it works has become essential for anyone navigating the ever-evolving landscape of finance.

Cryptocurrency is a decentralized form of digital currency that employs cryptography for secure financial transactions. Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on a technology called blockchain. This distributed ledger system is the backbone of most cryptocurrencies, ensuring transparency, security, and decentralization.

The pioneer of cryptocurrencies, Bitcoin, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Bitcoin, often referred to as digital gold, laid the foundation for the multitude of cryptocurrencies that followed. How does this technology work, and what sets it apart from traditional currencies?

The fundamental concept of cryptocurrency revolves around blockchain technology. A blockchain is a decentralized and distributed ledger that records all transactions across a network of computers. Each transaction is grouped into a block, and these blocks are linked together in a chronological chain. This chain is maintained across the entire network, ensuring a transparent and tamper-resistant record of transactions.

To initiate a cryptocurrency transaction, users need a digital wallet, a software program that allows them to store, send, and receive cryptocurrencies. Each wallet is associated with a pair of cryptographic keys: a public key (the recipient’s wallet address) and a private key (known only to the owner). The private key is crucial for securing the ownership of the cryptocurrency and should be kept confidential.

When a user initiates a transaction, it is broadcasted to the network and verified by a process known as mining. Mining involves solving complex mathematical problems that validate and add the transaction to the blockchain. In return for their efforts, miners are rewarded with newly created cryptocurrency and transaction fees. This mining process not only validates transactions but also ensures the security and integrity of the entire network.

One of the key features of cryptocurrencies is decentralization. Traditional currencies are controlled by central authorities like governments and banks, leading to concerns about potential abuse and manipulation. Cryptocurrencies, on the other hand, operate on a peer-to-peer network, eliminating the need for intermediaries. This decentralization fosters a level playing field, where users have more control over their funds and transactions.

Bitcoin, being the first and most well-known cryptocurrency, has gained recognition as a store of value similar to precious metals like gold. Its limited supply of 21 million coins, combined with the decentralized nature of its blockchain, contributes to its appeal as a hedge against inflation and economic uncertainties.

However, Bitcoin is just one among thousands of cryptocurrencies, each with its unique features and use cases. Ethereum, for instance, introduced the concept of smart contracts, self-executing contracts with the terms of the agreement directly written into code. This opened the door to a wide array of decentralized applications (DApps) and blockchain-based platforms beyond simple peer-to-peer transactions.

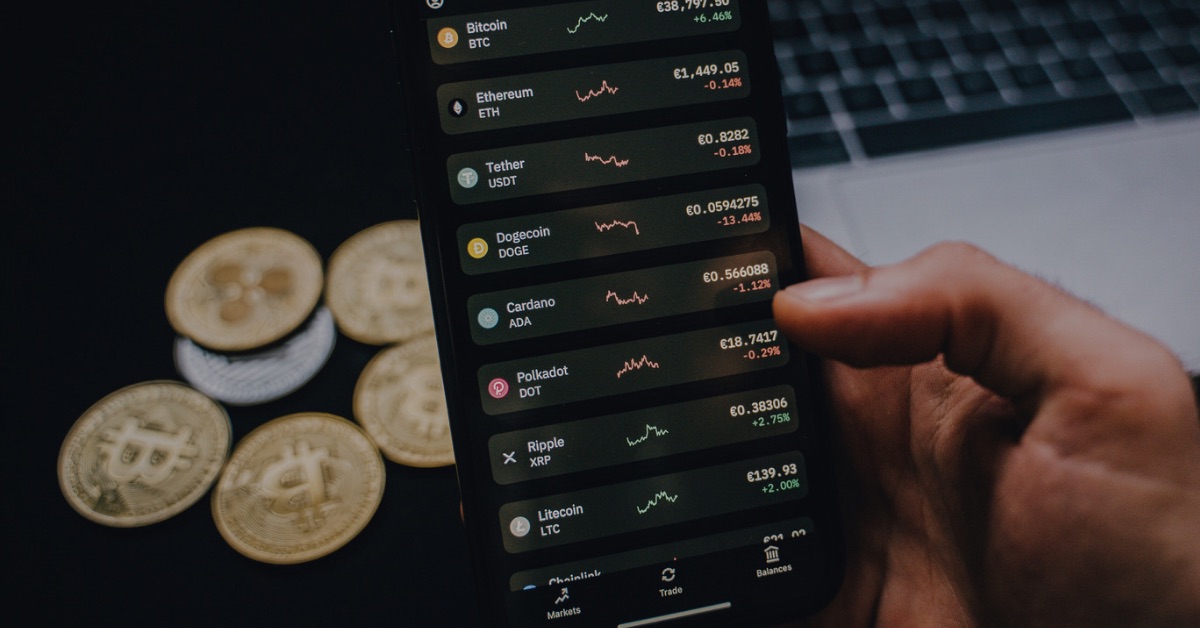

The rise of cryptocurrencies has not been without challenges. Volatility in cryptocurrency prices has been a point of concern, with values fluctuating dramatically over short periods. Regulatory scrutiny and legal uncertainties also loom over the industry, as governments grapple with how to integrate this new form of currency into existing financial systems.

Despite the challenges, the impact of cryptocurrencies on the financial landscape is undeniable. They provide an alternative means of transferring value globally, often faster and with lower fees than traditional banking systems. Moreover, cryptocurrencies enable financial inclusion for the unbanked population, granting access to financial services without the need for a traditional bank account.

Cryptocurrency represents a groundbreaking development in the world of finance. Its underlying technology, blockchain, has the potential to reshape various industries beyond currency, from supply chain management to healthcare. As we navigate this digital revolution, understanding the basics of what cryptocurrency is and how it works is essential for anyone looking to participate in the future of finance.

The rise of cryptocurrency signals a profound shift in the traditional paradigms of finance, ushering in an era where decentralization, transparency, and cryptographic security redefine the way we perceive and engage with currency. As the foundational technology of blockchain continues to evolve, the impact of cryptocurrencies reaches far beyond their role as digital assets or mediums of exchange.

The concept of decentralization, intrinsic to cryptocurrencies, challenges the conventional structures of authority in financial systems. By eliminating the need for central intermediaries, cryptocurrencies empower users with a level of control over their finances that was previously unthinkable. This shift towards peer-to-peer transactions not only enhances financial autonomy but also mitigates concerns related to potential abuse and manipulation by central entities.

While Bitcoin has paved the way as a digital store of value, the broader cryptocurrency landscape is teeming with innovation. Ethereum’s introduction of smart contracts and decentralized applications demonstrates the adaptability and versatility of blockchain technology. This expansion beyond simple peer-to-peer transactions opens doors to a wide array of possibilities, from self-executing agreements to decentralized finance (DeFi) platforms that offer a range of financial services without traditional banking infrastructure.

The inherent qualities of cryptocurrencies, such as limited supply and cryptographic security, position them as potential hedges against economic uncertainties and inflation. As the world grapples with fluctuating traditional markets, the appeal of assets like Bitcoin as a store of value gains prominence. Cryptocurrencies present an avenue for diversification in investment portfolios, offering an alternative to traditional assets like stocks and bonds.

Nevertheless, the cryptocurrency landscape is not without challenges. The volatility of cryptocurrency prices remains a significant concern, prompting debates about their viability as stable stores of value. Regulatory scrutiny and legal uncertainties add another layer of complexity, as governments worldwide navigate the integration of cryptocurrencies into existing financial frameworks.

Looking ahead, the transformative potential of cryptocurrencies extends beyond finance. The underlying blockchain technology has applications across various industries, ranging from supply chain management to healthcare. As blockchain becomes more ingrained in our daily lives, the transformative ripple effects are likely to reshape not just how we transact financially but how we interact with information, assets, and even each other in the digital realm.

In navigating this digital revolution, it becomes crucial for individuals, businesses, and policymakers to strike a balance between fostering innovation and addressing legitimate concerns. As cryptocurrencies become increasingly integrated into mainstream financial systems, proactive regulatory frameworks can help ensure the benefits of decentralization while mitigating risks associated with misuse and illicit activities.

In essence, the story of cryptocurrency is still unfolding, with each chapter marked by technological advancements, regulatory developments, and shifts in public perception. The journey from the creation of Bitcoin to the vibrant and diverse ecosystem of cryptocurrencies today showcases the dynamism inherent in this space. As we stand at the crossroads of traditional finance and the burgeoning world of digital assets, understanding the fundamentals of cryptocurrency is not just an exploration of a new form of currency but a journey into the heart of a transformative force that is reshaping the future of finance and beyond.